(seafood.vasep.com.vn) Vietnam’s seafood exports in the first 10 months of 2025 recorded significant progress, reaching more than USD 9.5 billion, up 15% year-on-year. This result reflects the sector’s persistent efforts amid a highly volatile market, especially policy shocks from the US Although signs of slowdown emerged in the third quarter due to countervailing taxes, key product groups still maintained strong momentum and created a foundation for full-year exports to reach USD 11 billion.

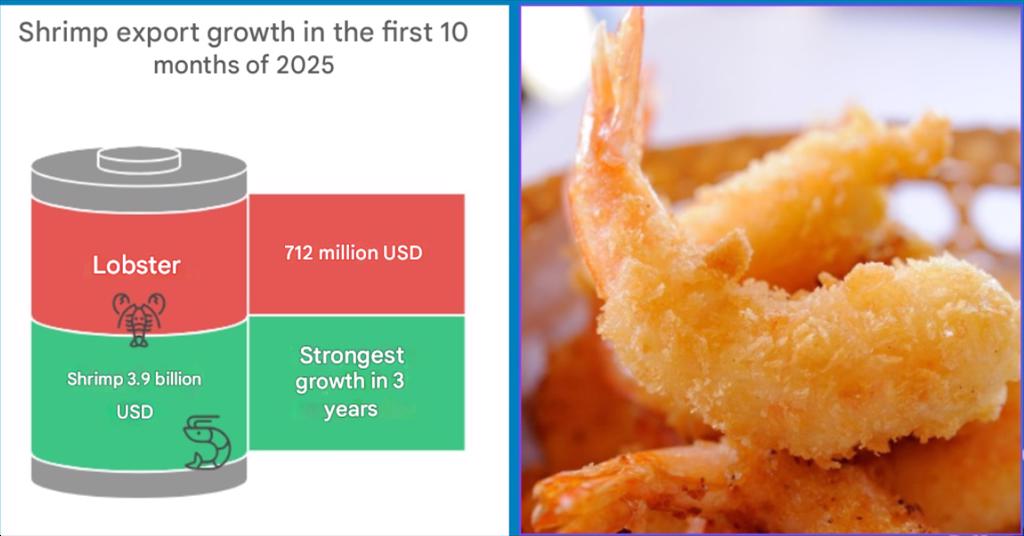

In the export product structure, shrimp continued to play the leading role with more than USD 3.9 billion in the 10-month period. Besides the stable growth of vannamei and black tiger shrimp, the highlight of this year was lobster – a product with a rare breakout, reaching over USD 712 million, up 134%. This boom stemmed from surging demand in China and Hong Kong for live and premium shrimp, especially in the HORECA segment.

Pangasius – the second major product – recorded an export value of about USD 1.8 billion after 10 months. Notably, tilapia became a new bright spot with an impressive growth of 220% to USD 62 million and is being shaped as a potential strategic product for Vietnam, with increasing demand in the US and several European countries.

Meanwhile, tuna continued to face heavy pressure. Ten-month exports remained around USD 791 million, nearly 4% lower year-on-year due to shortages of skipjack for canned processing and ongoing supply chain disruptions caused by conflicts in the Middle East. Some exporters had to scale down production or shift to loin products to reduce costs. In contrast, the squid and octopus group showed clear recovery, bringing total 10-month export value above USD 627 million; demand in Japan, South Korea and the US improved significantly, particularly for frozen products for processing. Fish cakes and surimi also drew attention, reaching USD 291 million in 10 months – up 24% year-on-year, becoming one of the fastest-growing product groups in the sector.

In terms of markets, China and Hong Kong continued to serve as an “important anchor” for Vietnam’s seafood industry in 2025. As of the end of October, exports to this market exceeded USD 2 billion, up more than 32%, particularly strong in lobster, marine fish and live crab. The rising year-end demand for live seafood is opening significant growth opportunities for Vietnamese exporters.

In contrast, the US market entered a period of high volatility. Although 10-month exports to the US still increased year-on-year, reaching around USD 1.66 billion, a clear downward trend appeared from the third quarter due to the 20% countervailing tax applied from August. Key products such as shrimp and pangasius – which account for a large share – both declined in September and October as many exporters proactively adjusted shipment volumes to avoid losses. In addition, other challenges such as anti-dumping duties on shrimp and MMPA regulations – expected to directly affect wild-caught seafood from early 2026 – have turned the US into a “risk hotspot” for the industry.

Exports to Japan continued to recover steadily, with a 10-month value of nearly USD 1.45 billion, supported by strong consumption of shrimp, squid, marine fish and pasteurized crab. The EU was also a strong-growing market, reaching USD 985 million in 10 months, benefiting from the bloc’s relaxation of certain technical barriers for Vietnam’s farmed seafood. Meanwhile, exports to South Korea maintained double-digit growth, reaching USD 725 million thanks to high demand for squid, octopus and surimi.

CPTPP markets – especially Canada, Australia and Japan – remained the fastest-growing region, showing Vietnam’s strong advantages in utilizing tariff preferences.

There will still be many challenges in 2026, particularly the prolonged US countervailing tax, the potential impact of MMPA, the likelihood that the EU will maintain the IUU yellow card, and increasing competitive pressure from India, Ecuador and Indonesia. This requires Vietnamese exporters to proactively restructure markets, strongly develop value-added products, invest in processing technology and enhance sustainability standards to maintain long-term growth.