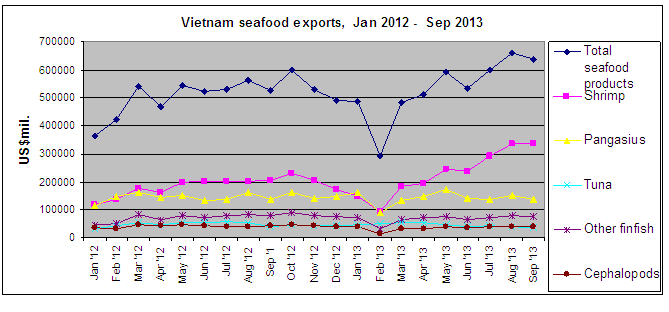

(vasep.com.vn) In QIII/2013, Vietnam’s seafood exports increased by 17.4 percent to US$1.9 billion in which exports of shrimp (dominated by whiteleg shrimp) reported a tremendous increase thanks to short supply of global shrimp and rising shrimp price; exports of other seafood items slowed down or decreased. In the first 9 months of 2013, Vietnam sold its seafood products to 156 markets, earning back US$4.8 billion, up 6.4 percent year-on-year.

According to REPORT ON VIETNAM SEAFOOD EXPORTS IN Q.III/2013, Vietnam seafood exports in the fourth quarter are expected to increases by 6.5% over the same period of 2012 to US$1.7 billion, mainly thanks to shrimp exports. Pangasius exports will hardly recover, exports of tuna and other marine products will be lower. Total seafood exports of 2013 is forecasted to reach US$ 6.5 billion, up 5% compared with 2012.

Sharp rise in shrimp exports, mainly whiteleg shrimp

Shrimp exports accounted for the largest proportion of 43 percent out of Vietnam’s total seafood sales. The figure was 7 percent higher than that of the same time of 2012 and much higher than the proportion of pangasius exports. Shrimp exports this year posted a reduction in February when Lunar New Year in Vietnam happens, exports in the remaining months marked two-digit growth of 20-66 percent. Remarkably, shrimp sales in QIII/2013 witnessed a surprising advance: exports in July up 45 percent, in August up 65.5 percent and in September up 61 percent.

Reasons for increase in shrimp exports: Raw shrimp exports from main suppliers like Thailand downed by half due to supply shortfall caused by diseases while shrimp price in main importing markets was US$2-4 per kilogram higher than that of 2012. Particularly, the growth in shrimp exports was largely due to sharp increase in whiteleg shrimp exports. In August 2013, whiteleg shrimp overcome black tiger shrimp with monthly earnings of US$180 – 190 million, 3 times higher than that of the same period last year and made up 54-56 percent of total shrimp sales. Until September 2013, whiteleg shrimp exports hit nearly US$980 million, rising 85 percent year-on-year and occupying 47.4 percent in the total shrimp export value while black tiger shrimp sales were US$943 million, increasing 4.8 percent and making up 45.7 percent.

Shrimp shipment in QIII/2013 gained US$961 million, up 57.3 percent year-on-year. The figure in the past 9 months of this year netted over US$2 billion, up 27 percent.

Shrimp exports to the U.S. scored the highest gain among importers of Vietnam shrimp. Exports to the market surged 63 percent through the year 2013 to September. In 3 months of QIII/2013 shrimp exports to the U.S. got three-digit growth: 102 percent in July, 145 percent in August and 139 percent in September.

Shrimp exports to the U.S. in the first 3 quarters of this year made up 26.3 percent out of Vietnam’s total shrimp exports to markets while the proportion reported in the same time last year was 20.5 percent.

In August 2013, the U.S. surpassed Japan as the top largest importer of Vietnam shrimp with monthly import value of over US$100 million. This trend is expected to continue in coming months when Christmas and New Year happen.

Slow recovery in pangasius exports

So far this year, pangasius exports has showed a slight rally in March and April and exports in May advanced the most on the back of seafood shows in Boston and Belgium foster the fish price up slightly. Exports of the item in remaining months of the year kept stable or fell slightly.

Pangasius exports this year may be lower than that of last year on account of stagnant demand from main markets (especially EU), instability in fish price and raw fish supply for processing.

Pangasius exports in QIII/2013 registered US$424 million, down 3.2 percent year-on-year and the figure in the past 9 months hit nearly US$1.3 billion, down 1.4 percent year-on-year. The proportion of pangasius out of the country’s total seafood sales slashed to 26.5 percent from 28.6 percent.

Pangasius exports to the U.S. were on the increase while fish exports to EU were on the wane due to sluggish demand caused by regional economic downturn. Since April 2013, the U.S. has overtaken EU as an importer of Vietnam pangasius. In Jan-Sep 2013, fish exports to the U.S. obtained nearly US$300 million, up 2.2 percent while exports of the item to EU gained US$285 million, down 11.25 percent.

Tuna exports posted the decline

Shipment of tuna and marine finfish this year slowed down and dropped slightly compared to the same period of 2012. The decline was due to high tuna inventory in EU, Japan which boosted importing of these items in 2012. In addition, the fact Vietnam tuna exporters must subject to stricter quality requirements imposed by importers and undersupply for processing also were reasons for the drop in tuna exports during the reporting time.

Tuna exports in QIII/2013 netted US$121 million, down 18.3 percent year-on-year; tuna exports up to September 2013 totaled US$415 million, down 4.5 percent.

Cephalopod exports saw one-year reduction

In the period from July 2012 to June 2013, Vietnam’s cephalopod exports witnessed monthly continuous decline of 16-30 percent year-on-year. In QIII/2013, shipment of this item showed signs of improvement: exports in Jul, Aug and Sep watched one-digit reduction of 1.6 percent, 6.2 percent, 7.6 percent, respectively. Raw cephalopod shortfall for processing was mainly blaming for the decline in Vietnam’s cephalopod exports. Furthermore, weak demand and low export cephalopod price caused by economic distress, high inventory in importing markets and stronger competition from rivals (China, Senegal or Mauritania...) were also reasons for the decline.

Cephalopod exports in the first 3 quarters of 2013 downed 17.2 percent to US$309.5 million in which exports in QI and QII slipped 20 percent, exports in QIII downed 5.4 percent to US$117 million.

Like this article, please subscribe VASEP report.