(seafood.vasep.com.vn) The latest data shows that the domestic market continues to be the foundation for Vinh Hoan Corp 's (VHC) business activities while export activities have not clearly recovered.

The domestic market continues to be the foundation for Vinh Hoan Corp

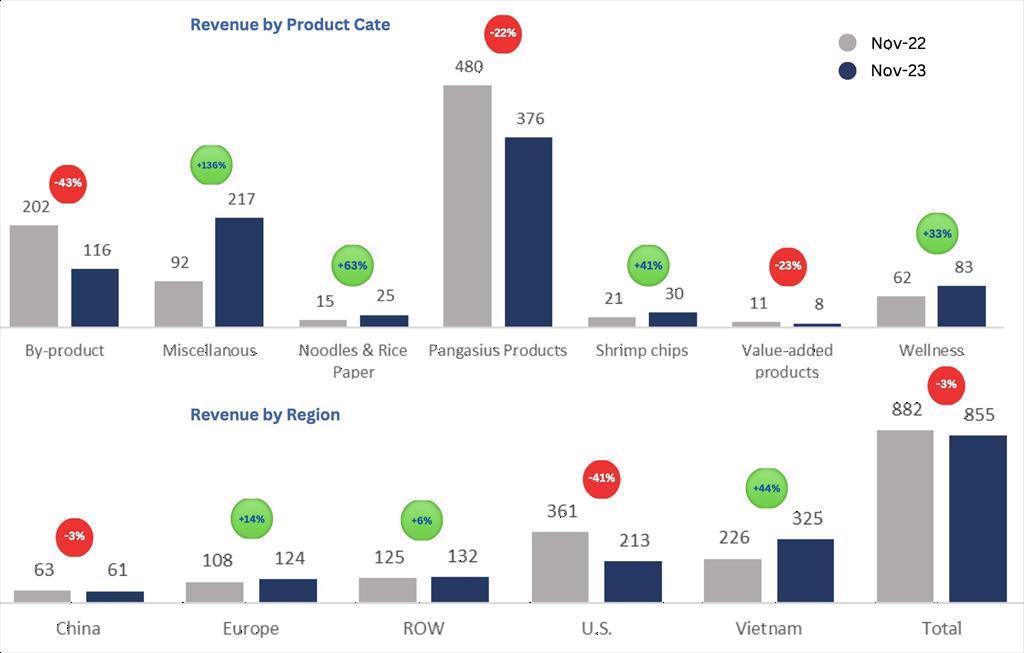

Vinh Hoan Corporation (Vinh Hoan Corp, HoSE: VHC) has just announced business results for November 2023 with a revenue of 855 billion VND, down 3% compared to the same period last year but increasing 14% compared to October 2023.

In terms of products, the business categories of Vinh Hoan Corp have been differentiated. Specifically, pangasius products recorded revenue of 376 billion VND and the by-product category reached 116 billion VND, down 22% and 43% respectively compared to the same period last year. These are also the two categories that contribute the most to Vinh Hoan Corp's total revenue.

Meanwhile, other sub-businesses of Vinh Hoan Corp recorded impressive growth. Revenue of wellness products; shrimp chips; noodles & rice paper; and other miscellaneous producsts increased by 33%; 41%; 63%; and 136% respectively. These categories have kept Vinh Hoan Corp's total revenue from decreasing sharply compared to the same period last year.

In terms of consumption markets, the domestic market continues to become the supporting platform for Vinh Hoan Corp in November 2023 with revenue of 325 billion VND (accounting for 38% of total revenue), up 44% compared to the same period last year.

Meanwhile, export revenue to the US, which is the main market of Vinh Hoan Corp, only reached 213 billion VND (accounting for 40% of total export revenue), down 41% over the same period last year. At the same time, exports to China reached 63 billion VND, decrease slightly by 3%. Notably, exports to the EU continued to record positive signs with a growth rate of 14%, reaching 124 billion VND.

Vinh Hoan Corp is currently the top leading enterprise in processing and exporting pangasius industry in Vietnam, accounting for about 15% of the country's total pangasius export turnover.

Pangasius prices may gradually recover from the second half of 2024

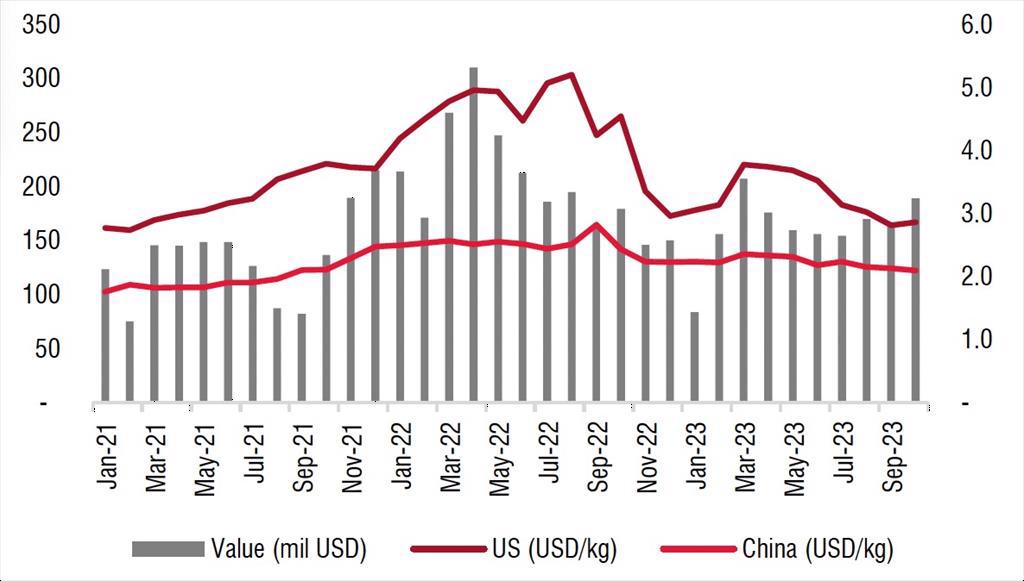

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), by the end of November 2023, Vietnam's pangasius exports reached nearly 1.7 billion USD, down 26% over the same period last year. The average price of pangasius exports decreased in major markets, especially the US and China, pulling the value of pangasius exports lower than in 2022.

Vinh Hoan Corp currently records a larger decline in export revenue than its competitors in the same industry, mainly because the US is the market with the largest decrease in pangasius exports from Vietnam.

However, in terms of net profit and profit margin, Vinh Hoan Corp (net profit margin is 7.4%) still recorded superior results compared to other export enterprises because the average selling price of the US is still higher than the export market in general, so profits decrease less.

In October 2023, the average selling price of pangasius in the US market reached 2.9 USD/kg, down 37% compared to October 2022 but up 2% compared to September 2023. The average selling price of pangasius in China is 2.1 USD/kg, down 13% compared to October 2022 and down 2% compared to September 2023. Pangasius prices in the US and China are currently continuing the downward trend since August 2022.

According to SSI Research, based on historical data, it is expected to take about 1.5 - 2 years for pangasius prices to hit bottom and a full cycle of the industry takes place in about 4 years. Therefore, pangasius prices are forecast to recover positively from the second half of 2024 (corresponding to the fact that it will take 2 years for prices to hit bottom). Current data shows that the total value of inventory in the US market remains high but has begun to decrease at a slow pace.

In addition, the prices of raw fish and broodstock in November 2023 have decreased by 10% and 18% respectively, compared to the same period last year. Input prices for aquatic feed (accounting for 60% of cost of goods sold) peaked in May 2023 and began to decrease from June - August 2023. This partially supported the gross profit margin of businesses like Vinh Hoan Corp.

On the stock market, as of December 15, the market price of VHC reached 72,900 VND/share, almost equivalent to the beginning of this year.