(vasep.com.vn) In recent years, Japan has tightened their control on banned chemical testing on shrimp products imported from Vietnam.

Japan tightening banned chemical testing on Vietnam shrimp

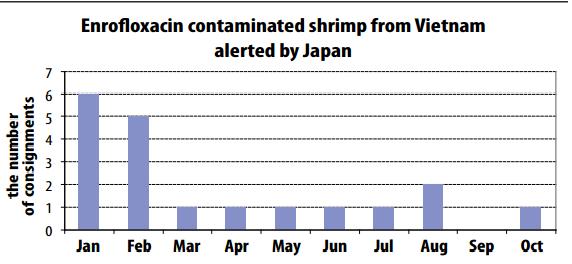

In 2010, Japan intensified to inspect Trifluralin. In 2011, the market continued to inspect Enrofloxacin in shrimp originated from Vietnam in which maximum residue limit (MRL) was ten times lower than that of EU. In 2012, Vietnam shrimp products suffered from Ethoxyquin testing with MRL of 0.01 ppm.

Ethoxyquin and its impacts on Vietnam shrimp sector

Since May 18th 2012, Japanese authorities have decided to test Ethoxyquin residue on shrimp consignments originated from Vietnam with MRL of 0.01 ppm (10ppb). Ethoxyquin is not a harmful substance and is popularly used as an anti-oxidant substance in fishmeal – the main ingredient in animal feed production. Developed countries, including Japan allow to use Ethoxyquin in fishmeal products with MRL of 75 – 150ppm.

Japan’s Ethoxyquin test on Vietnam shrimp has negatively affected to Vietnam shrimp exporters to the market because MRL of 0.01 ppm is too low and unfair to Vietnam’s shrimp exporters.

Although Vietnam’s management agencies and shrimp enterprises and farmers took great efforts to control Ethoxyquin residue, they still failed to ensure Ethoxyquin residue below MRL of 0.01 ppm in their products.

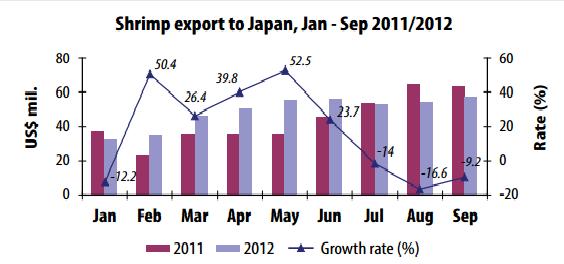

The number of shrimp consigments exported to Japan which contain Ethoxyquin residue has reduced remarkably. Shrimp exports to Japan declined after strong growth of 23 – 52.5 percent in 5 months. In July 2012, shrimp shipments to Japan dropped by 1.4 percent over that of the same month of 2011. The figure was 16.6 percent in August and 9.2 percent in September. Shipments in the next months are expected to decrease.

Shrimp export price of Vietnam and India (two countries subjected to Japan’s Ethoxyquin residue inspection) fell sharply since the late September of this year. According to statistics on shrimp import price into Japan at website www.fis.com, shrimp price in all counts reduced from that of the previous week. The price of HLSO shrimp count 8/12 originated from Vietnam fell by US$2.41/box of 1.8 kilogram; HLSO shrimp count 26/30 from India sank by US$4.4/box of 1.8 kilogram.

Shrimp export represents 36 – 38 percent of Vietnam’s total seafood export turnover creating jobs and income for 1.5 million of labors. In 2011, Vietnam shrimp shipments hit over US$2.4 billion in which shipments to Japan occupied 28 percent. However, Ethoxyquin residue inspection created burdens on many shrimp exporters in Vietnam.

In the Mekong River Delta, 70 percent of shrimp processing plants are experiencing under-capacity operation due to raw material shortage and rocketing price of raw material and pressures from Japan’s Ethoxyquin test since May 2012.100 shrimp exporters with over 500,000 workers are directly affected by Japan’s Ethoxyquin testing.

To many exporters, Japan is an important consumer market, taking over 60 percent of their total shrimp exports to Japan. Many shrimp processors stopped purchasing raw shrimp farmed under industrial model on a fear of Ethoxyquin contamination. Some packers stop to export shrimp to Japan. Others which tried to remain exporting to the market must purchase extensively farmed shrimp for processing or spend a lot of money on testing raw shrimp before processing.

However, the supply of extensively raw farmed shrimp can not meet processors’ demand for raw material. Besides, costs for shrimp testing exposed hardship in capital for exporters and slashed sharply their profit.

Japan’s requirement of Ethoxyquin test pushed Vietnam shrimp price up and reduced its competitiveness in Japan market. Another problem is that Japan’s technical barriers forced exporters to switch to export to other markets where Vietnam shrimp exporters must suffer from high pressures on price with other suppliers.

|

Japan’s seafood exports to Vietnam (US$ mil.)

|

|

HS code

|

Products

|

2009

|

2010

|

2011

|

|

'0303

|

Frozen whole finfish

|

21.580

|

27.209

|

70.199

|

|

'0307

|

Mollusk

|

6.849

|

20.514

|

66.573

|

|

'0306

|

Crustacean

|

325

|

452

|

1.644

|

|

'0304

|

Fish fillets, frozen/chilled/live/ fish steaks

|

229

|

255

|

393

|

|

'0305

|

Smoked finfish and fishmeal

|

204

|

90

|

364

|

|

'0301

|

Live finfish

|

50

|

120

|

116

|

|

'0302

|

Live whole finfish

|

12

|

0

|

29

|

|

|

Total

|

29.249

|

48.640

|

139.318

|

|

Source: ITC

|

VASEP’s petitions to solve Ethoxyquin problem

Japan market is the key consumer market of Vietnam shrimp, however, exporters don’t dare to export their products to the market due to Ethoxyquin testing by Japan. To protect the reputation of Vietnam shrimp in the Japan market and help exporters avoid losses, Vietnam Association of Seafood Exporters and Producers (VASEP) and enterprise community proposed five solutions:

(1) Japan’s management agencies of hygiene and food safety adjust MRL for Ethoxyquin in imported shrimp from 10 ppb to 1000ppb (1ppm), equating to the level applied for finfish.

(2) Vietnam shrimp sector want to get a chance of learning experiences and techniques of Japan and Thailand in producing and using feed in shrimp farming in order to ensure allowable Ethoxyquin residues in shrimp.

(3) A high-ranking delegation (at a governmental level) shoud visit and work with Japan government to seek out solutions to solve “Ethoxyquin problem”.

(4) “Ethoxyquin problem” can be discussed in common forums about WTO’s sanitary and phytosanitary standards (SPS) in March 2013 in Geneva. If necessary, Vietnam can impose the equivalent measures against Japan. Vietnam can stop importing seafood from Japan exporters which don’t meet hygiene standards and food safety pursuant to Ministry of Agriculture and Rural Development’s Circular No. 25).

(5) Vietnam can learn about India in solving “Ethoxyquin problem”.

Vietnam’s seafood trade relation with Japan

Japan is considered as an important market of Vietnam seafood (the third largest market of seafood and the largest market of shrimp. Shrimp exports to the market accounted for 25 – 30 percent of Vietnam’s total shrimp export value.

Shrimp shipment to Japan obtained over US$600 million per year, representing 25 percent of total shrimp export value and 60 percent of total seafood export value to Japan. Vietnam highly appreciates Japan market due to its high consumption demand, reasonable import price and good paying capacity.

Vietnam is also a large importer of Japan seafood, particularly tuna, salmon, mackerel, hake, sole fish, cephalopod and other marine finfish.

Raw fish imports from Japan into Vietnam experienced consecutive annual growth. Exports of Japan seafood to Vietnam are increasingly surging. In 2009, Japan seafood exports to Vietnam occupied 2.7 percent of Japan’s total seafood exports. The figure surged to 3.8 percent in 2010 and rose to 11.4 percent in 2011