Let’s hope the new year can bring some major positive changes to the troubled U.S. canned tuna market because 2012 saw its imports shrink momentously by a whopping one quarter. The devastating blow to exporters came as American tuna brands struggled to stay afloat amid record high raw material costs, declining consumer demand and the continued negative publicity on mercury and tuna.

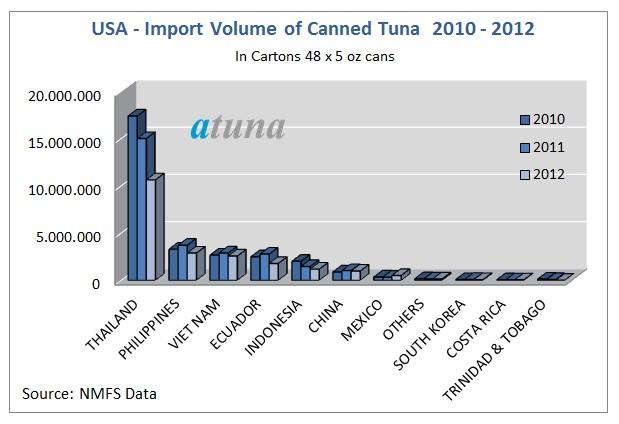

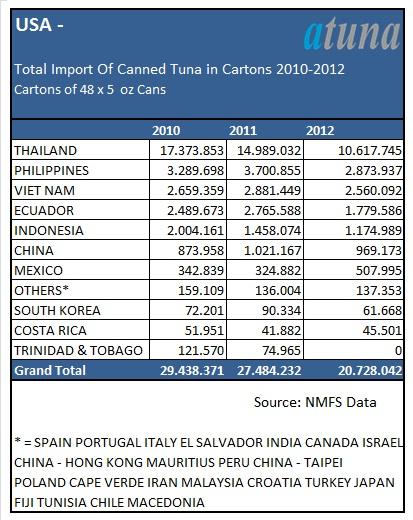

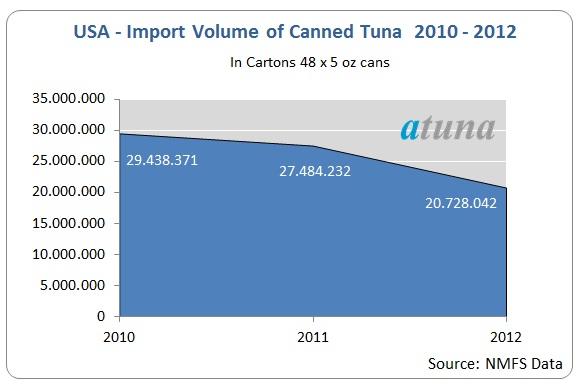

Last year, the total import volume of canned tuna crashed down to 20.7 million cartons, down 25% from 27.5 million in 2011 and 30% less than three years ago. The majority of the top 10 tuna producers who ship to the US market – including Thailand, Philippines, and Vietnam – were forced to significantly reduce their exports in 2012.

Thailand, the dominant US tuna supplier, saw its exports fall by 29% from 2011 to hit 10.6 million cartons. Philippines and Vietnam, in a distant second and third with an export volume of less than three million cartons each, also reduced their shipments by 22% and 11% respectively from 2011.

US canneries also bought less pre-cooked frozen tuna loins last year – down 14% to total about 53,900 tons from 2011 – so any illusion of increased domestic tuna production to offset the reduced canned tuna imports is misguided. The US canned tuna market is truly in a severe crisis.

The country’s tuna brands, to start, had to deal with dramatically higher import FOB prices last year, which on average, jumped by 33% from 2011 to USD 42.17 per case of 48x 5oz. The prices of raw skipjack – light meat tuna were to blame here, peaking near USD 2,300 per ton in September 2012 and causing supply problems for processors. Besides the higher canned tuna import costs, the Big Three US tuna brands faced fierce competition from each other and also private labels over market shares, forcing them to keep the selling price competitive but leaving hardly space for any profit.

But, industry efforts to retain consumers do not appear to be working. In the last year market data shows that Americans decreased their tuna intake by 12% and the shrinking demand could be the result of a number of other factors, besides rising retail prices. The product quality itself seems to be a continuing problem, with one Boston newspaper recently reviewing seven American tuna brands and reporting largely dissatisfied results. Culinary students from the local university were the judges and their comments ranged from “disturbingly moist, soggy, and uncomfortably soft in the mouth” to “looks like mushy wet cardboard. Sadly, it tastes like it too.” The excessive use of hydro proteins and vegetable broths in an effort to get the highest retention rates has completely back fired.

One leading US brand has even taken steps to fix the “mess” – last spring, Chicken of the Sea launched a line of “no drain” canned tuna products to promote a cleaner, more pleasant eating experience. The company, owned by the world’s largest canned tuna producer Thai Union, has since reported that the products have become a sales hit, with consumers specifically requesting it in stores.

Tuna’s popularity in the US is also certainly harmed by the country’s media who continue to unleash mercury scares on the public. The alleged health risks from eating tuna are often plastered across headlines, when the “new” research doesn’t actually study the real effects of mercury in tuna or the final negative and possible positive health effects on consumers. The articles commonly ignore the critical fact that selenium, another element found in tuna, works as a natural defense against mercury and it induces healthy brain development.

The fact remains that the once booming American tuna market is now in decay. As US tuna companies try to rebuild with new strategies – the industry’s move to smaller, 5-ounce cans clearly did not work - it will be interesting to see how and if they can reverse the downward trends.

This dramatic drop in the demand for tuna in the United States represents approximately 100.000 M/T less of whole round frozen skipjack, which is the raw material for US light meat. Considering that global catches are around 4 million M/T , the volume lost in the USA is equivalent to only 2,3% in world uptake.