In reading the filing to the Dept. of commerce prepared by the Coalition of Gulf Shrimp Industries, I was struck by some of the financial data.

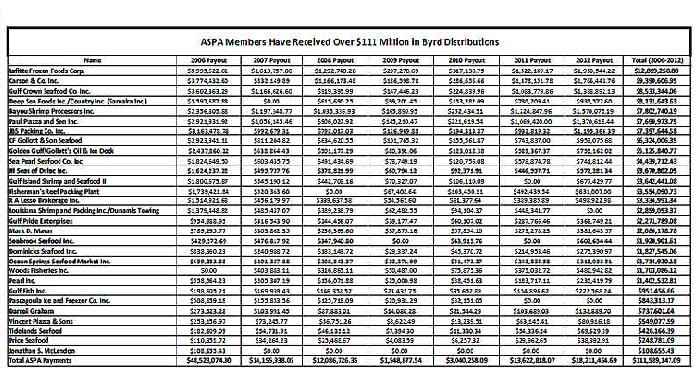

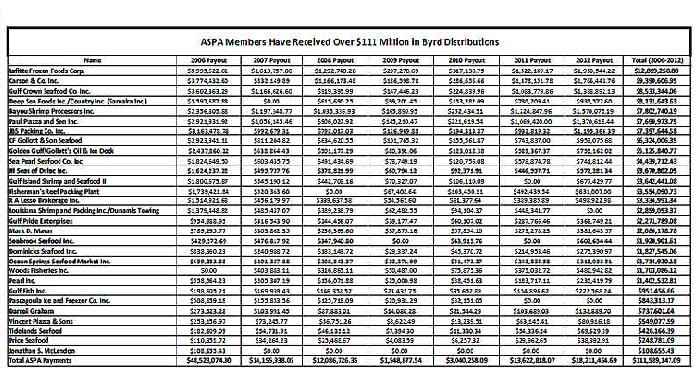

These companies, virtually all of whom are members of the American Shrimp Processors Association, have received over $111 million in Byrd Amendment payments from the US government since 2006.

What is striking is that in their filing, they claim that the total gross profit for the industry for the last three years has averaged around 38 million per year - or 114 million total. The Byrd payouts have been equal to virtually the entire profits of the industry over the past three years.

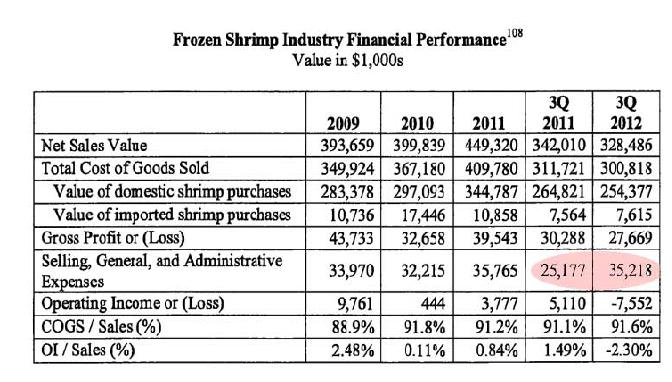

Furthermore, they allege that due to the injury from lower priced imported shrimp, they have lost money in 2012.

The relevant table from their filing is below.

Page 1-45 in COGSI petition filed with Dept. of Commerce. Jump in Admin expenses highlighted in red

Through the 3rd quarter of 2012, they claim the industry's gross operating income is -7.5 million. But what jumped out at me was the staggering $10 million increase in the 'selling general and admin expense' line just above. The entire projected loss was due to a 40% jump in sales and admin, according to their filing.

Industry scuttlebutt, which has not been confirmed by any individual company, is that the members of the coalition were being asked to pay $200 to 300K to support the countervailing duty suit. It is uncannily coincidental that the jump in admin expenses of $10 million is so close to the amount raised if 30 companies had each put in $300 K - i.e. that would be a $9 million jump in admin expenses.

Now there is nothing factual here - there is no indication as to how the funds were raised, and what proportion has been paid into a legal account. But the $10 million jump in admin expense, coupled with a $7.5 million claimed loss, is a red flag.

Without that jump in administrative expense, the industry would have been profitable through the 3rd quarter of 2012, compared to the 3rd quarter (cumulative) of 2011.

The entire argument is one of injury - that the domestic shrimp processors lost money in 2012 because of a fall in shrimp prices caused by decline in the price of imported shrimp. Yet, the proximate cause was an unexplained jump in administrative expenses of $10 million, or 40% year over year.

Increases in administrative expenses are not due to the actions of foreign exporters - regardless of the merits of an argument over subsidies.

The argument for injury would be much stronger if the other factors such as administrative and sales expenses had remained more constant and consistent, as they had during the three prior years.

We address these issues in our video, and suggest that there is a better course the industry could have followed, such as putting a fraction of the $111 million they received from the government into marketing their products and raising the value, and distinctiveness of domestic shrimp.

Farmed shrimp is here to stay. It will always supply 80% to 90% of the US market. The challenge for the domestic industry is not to claim their shrimp and farmed shrimp are fungible substitutes for each other, but to recognize they have a unique wild product that can stand on its own.

There are many similarities to the situation faced by the Alaskan salmon industry in the early 1990's. The explosion of farmed salmon totally turned their market upside down. They did not go to the government for a handout, but spent money marketing their product and establishing a differentiation between wild and farmed salmon.

Today despite low farmed salmon prices, canned Alaskan salmon is trading at some of the highest prices ever, and wild salmon at retail consistently gets a large premium over farmed salmon.